As your career develops, you'll find there are a few areas you need to get comfortable with when it comes to your money. First, of course, is your career itself. Second is your spending habits. Third is – the topic of today's study – how to save and invest your money.

And it's an important topic! Today we're going to talk about how you invest it. You – like many others – are probably wondering if you can get rich with stocks (or at least build wealth).

How to Make Money: Good Financial Decisions Over a Long Timeframe

If you're just looking to invest, we can help you there. For a beginner to stocks, we recommend passive investing with M1 Finance. You can undertake the strategy in this article simply by buying an index fund like VTI.

Financial sites like to stress that good decisions over a sufficiently long timeframe lead to very good results.

Applied to your retirement, that means small savings sacrifices over a long career. Low touch investments compounded at a reasonable rate means a huge sum at the end.

With that stated: just how reliable is that “reasonable rate” assumption?

Value Investing on a Moderate Income

CNBC shared an awesome investing story about Ronald Read, a Vermont gas station attendant and janitor. He passed away at 92 years old with an $8 million estate consisting of dividend paying stocks he purchased over his career.

Not only did he amass that huge sum, but he also did it relatively anonymously. He was known as frugal during his lifetime, and donated much of his estate to a local library and hospital.

By all accounts, he maintained his frugal lifestyle through retirement. He even retained a number of paper shares of large company stocks in a lock box when he died.

Since Mr. Read graduated high school in 1940 and served in the Armed Forces during World War II, that means he likely started investing around 1945 or 1946. We, with the benefit of 20/20 hindsight, know that the mid-1940s were a particularly fortuitous time to sink a large amount of money into the stock market.

Was Read just lucky? Are stocks the best way to invest money and grow wealth?

The question is: how fortuitous was Mr. Read?

Jesse Livermore, anonymous financial writer at the site Philosophical Economics, shared his take on Read's fortune. His conclusion: there are only a few periods in US history that stocks have returned over 8% annualized (and inflation adjusted) for 65 subsequent years.

One of them roughly started at the mid-point of World War II – 1942-1943.

Livermore's take is excellent, and his math is unimpeachable. He concluded that younger workers will not be able to come close to Read's results by investing if the market remains at its current valuation.

Although his conclusions are probably a bit tongue-in-cheek, it's a good point. If you assume valuations at the time of Read's death would revert to mean, a person starting investing then would have a tougher row.

Restated: it'd take a lot more sacrifice to reach the same results.

The Typical Investor Can Grow Wealth with Stocks

Read invested in individual stocks, which (to borrow from another investor, Warren Buffett) can be viewed more as boats which rise with the tide. However, these 'boats' have different levels of buoancy.

Could a typical investor have matched Mr. Read's Performance with Index Funds?

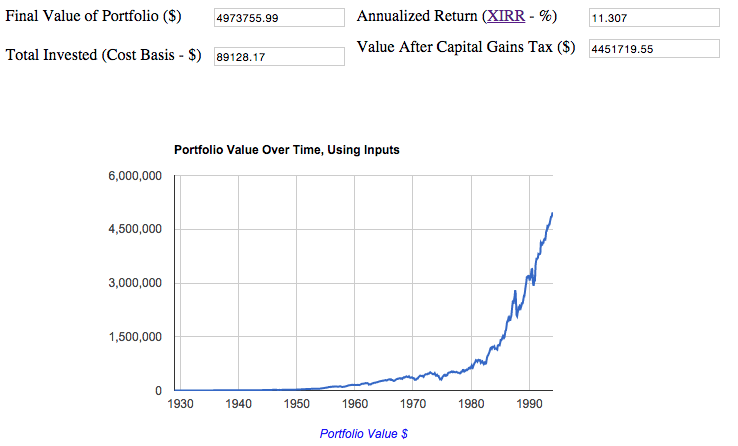

From February of 1948 to February of 2015, and ignoring taxes and management fees, $53 a month adjusted for inflation would give you about $7.95 million dollars. That $53 was about $530 a month in February 2015.

Add taxes on a median income and a management fee and you're still in the $4.5 million dollar range. (Note that many of those years are pre-index fund, so management fees would have been larger).

Now, $530 a month is doable for a lot of households in America.

Note that even a young, single person has access to more tax-free investing space than needed across a 401(k), IRA and HSA.

We will conclude that a typical investor could have matched Read over his investing career. Around $6,000 in 2015 dollars is not an insurmountable annual savings amount for many incomes.

Could a low-income investor have matched Mr. Read's stock investing performance?

Of course, it would be much harder to save the money Read needed on the average $25,140 2015 janitor's wage. That's roughly a 25% gross savings rate, and closer to 30% net based on 2015 levels of tax.

It's a much harder lift. That frugal janitor already has cut most expenses...

However, let's say Livermore's scenario, where valuation is held constant at roughly a 27.2 Shiller P/E, comes true. (Along with normal earnings growth).

It quickly moves out of reach for our theoretical janitor. That math pencils out to $1,831 in savings a month. A young worker of above average means could still hit it, but it's undeniably harder.

Not even the most frugal super saver could match Mr. Read in that scenario.

Is the Stock Market's Performance Unsustainable?

We can reasonably expect that constantly high valuations aren't the case.

While lofty values are excellent for people drawing down their wealth (retirees and financially independent people), they are dangerous for people in their 20s through 40s.

These workers are still in the (relatively) early accumulation stage of their careers. If they buy all of their stock at a permanently high level, then only huge increases in earnings per share can save us.

If valuations are permanently high, it also might mean there is no need for the equity risk premium to exist anymore. The equity risk premium, roughly, is the idea that it's uncertainty in stock prices driving excess returns of stocks over bonds.

Comparing the Great Depression to Highly Valued Stock Markets

I looked at a different 65 year time frame – one where valuations were at a similar level to those in 2015: January of 1929. Ten months later marked the beginning of the Great Depression.

Why? It's possible the market may retain a high valuation over a long periods. However, it probably won't stay high for 65 years.

Here's the scenario:

- Investor who started investing in January 1929

- Increases their monthly contribution for inflation (CPI)

- Held on for 65 years (January 1994)

... they'd only have needed to invest $575 in 2014 dollars, up from $530.

That would leave them at $5,000,000 in (pre-tax) gains in January of 1994. Inflation adjusted, that would have been $8,000,000 in 2015 – or they could have invested the $5 million for even greater gains.

Comparing the Great Depression to Highly Valued Stock Markets

Not to trivialize it, but $45 additional dollars due to bad timing in the markets should be doable. It is possible to get rich with stocks - and potentially even build huge wealth.

And, remember, this article is probably an overshoot. On a janitor's salary, $8,000,000 would probably be welcome yet overkill. That amount of money is a "nice problem to have".

You Can Grow Rich with Stocks, but There's Risk

It's inappropriate to close this article on America without a mention of when aggressive stock investing has failed. Witness our Nikkei Return Calculator; over the course of a generation and a half Japanese stocks haven't returned much of anything.

Wade Pfau has some research on safe withdrawal rates across various times and countries - and Canada and the United States are near the top. Is it just better to be lucky than good?

In the US, historically, the best investor strategy has been to bury your head in the sand and dollar cost your way to truly eye-opening returns.

You've always seen a positive return over many years in our country's history. See our S&P 500 historical return calculator here to prove it.

Still - a prolonged crisis would be a bigger problem than your stock investments, anyway. You can get rich with stocks, you just need to take the risk. You can grow wealth by putting your money into the stock market over a long timeframe.

Our suggestion? Start passive investing for free with M1 Finance. You can park your funds in a S&P 500 index fund and cross your fingers. You'll probably do okay, even if not on par with Mr. Read.

However, as you can see none of this is guaranteed. The key takeaway is you can't get rich with stocks without taking on some risk. I, personally, think the risk is worth it.