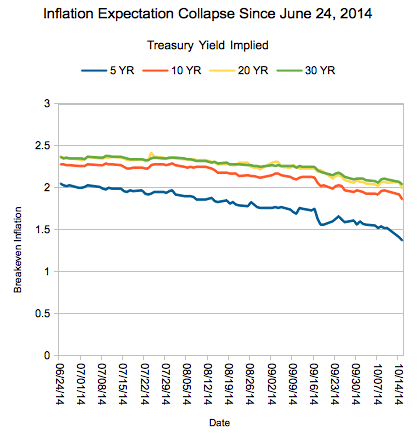

One situation we've been monitoring closely (even before the recent market activity) and has only just started to become a bit dramatic: the rapidly declining inflation expectations among market participants. One way to follow this measure is to follow the 'breakevens'; by subtracting real yields on inflation protected securities from treasuries, you can graph the point where the market has converged on inflation expectations.

Since June 24th, those expectations have dropped precipitously:

We have, of course, created an inflation breakeven calculator if you want to track this information easily (and graphically!).

Here are the raw numbers (annualized percentages):

| DATE | 5 YR | 10 YR | 20 YR | 30 YR |

| 06/24/14 | 2.05 | 2.28 | 2.36 | 2.37 |

| 06/25/14 | 2.03 | 2.28 | 2.36 | 2.35 |

| 06/26/14 | 2.02 | 2.27 | 2.35 | 2.36 |

| 06/27/14 | 2.03 | 2.27 | 2.35 | 2.35 |

| 06/30/14 | 2 | 2.26 | 2.34 | 2.35 |

| 07/01/14 | 2 | 2.26 | 2.33 | 2.35 |

| 07/02/14 | 2.01 | 2.26 | 2.35 | 2.34 |

| 07/03/14 | 2.03 | 2.28 | 2.37 | 2.37 |

| 07/07/14 | 2.01 | 2.27 | 2.35 | 2.36 |

| 07/08/14 | 1.99 | 2.27 | 2.35 | 2.36 |

| 07/09/14 | 1.98 | 2.29 | 2.36 | 2.38 |

| 07/10/14 | 2 | 2.28 | 2.36 | 2.38 |

| 07/11/14 | 1.99 | 2.28 | 2.37 | 2.37 |

| 07/14/14 | 1.99 | 2.27 | 2.36 | 2.37 |

| 07/15/14 | 1.96 | 2.25 | 2.35 | 2.36 |

| 07/16/14 | 1.95 | 2.23 | 2.33 | 2.35 |

| 07/17/14 | 1.97 | 2.23 | 2.33 | 2.34 |

| 07/18/14 | 1.96 | 2.24 | 2.33 | 2.34 |

| 07/21/14 | 1.97 | 2.24 | 2.34 | 2.34 |

| 07/22/14 | 1.93 | 2.23 | 2.32 | 2.33 |

| 07/23/14 | 1.92 | 2.23 | 2.32 | 2.33 |

| 07/24/14 | 1.93 | 2.27 | 2.42 | 2.35 |

| 07/25/14 | 1.95 | 2.28 | 2.37 | 2.36 |

| 07/28/14 | 1.95 | 2.28 | 2.36 | 2.35 |

| 07/29/14 | 1.94 | 2.27 | 2.35 | 2.35 |

| 07/30/14 | 1.96 | 2.28 | 2.35 | 2.36 |

| 07/31/14 | 1.97 | 2.29 | 2.36 | 2.36 |

| 08/01/14 | 1.92 | 2.27 | 2.35 | 2.36 |

| 08/04/14 | 1.9 | 2.25 | 2.34 | 2.35 |

| 08/05/14 | 1.9 | 2.24 | 2.34 | 2.34 |

| 08/06/14 | 1.9 | 2.25 | 2.34 | 2.34 |

| 08/07/14 | 1.89 | 2.24 | 2.34 | 2.33 |

| 08/08/14 | 1.86 | 2.25 | 2.33 | 2.32 |

| 08/11/14 | 1.86 | 2.25 | 2.33 | 2.32 |

| 08/12/14 | 1.87 | 2.24 | 2.32 | 2.31 |

| 08/13/14 | 1.88 | 2.23 | 2.31 | 2.3 |

| 08/14/14 | 1.84 | 2.21 | 2.3 | 2.31 |

| 08/15/14 | 1.83 | 2.18 | 2.28 | 2.29 |

| 08/18/14 | 1.85 | 2.18 | 2.28 | 2.3 |

| 08/19/14 | 1.81 | 2.17 | 2.28 | 2.28 |

| 08/20/14 | 1.83 | 2.17 | 2.27 | 2.28 |

| 08/21/14 | 1.8 | 2.17 | 2.27 | 2.28 |

| 08/22/14 | 1.79 | 2.14 | 2.3 | 2.28 |

| 08/25/14 | 1.78 | 2.15 | 2.3 | 2.27 |

| 08/26/14 | 1.83 | 2.14 | 2.25 | 2.27 |

| 08/27/14 | 1.8 | 2.14 | 2.24 | 2.26 |

| 08/28/14 | 1.77 | 2.13 | 2.24 | 2.26 |

| 08/29/14 | 1.76 | 2.12 | 2.22 | 2.25 |

| 09/02/14 | 1.76 | 2.15 | 2.3 | 2.27 |

| 09/03/14 | 1.77 | 2.17 | 2.31 | 2.26 |

| 09/04/14 | 1.76 | 2.17 | 2.31 | 2.27 |

| 09/05/14 | 1.77 | 2.15 | 2.25 | 2.26 |

| 09/08/14 | 1.74 | 2.13 | 2.24 | 2.26 |

| 09/09/14 | 1.71 | 2.11 | 2.27 | 2.26 |

| 09/10/14 | 1.69 | 2.1 | 2.25 | 2.24 |

| 09/11/14 | 1.76 | 2.12 | 2.23 | 2.26 |

| 09/12/14 | 1.75 | 2.13 | 2.23 | 2.25 |

| 09/15/14 | 1.73 | 2.13 | 2.23 | 2.25 |

| 09/16/14 | 1.75 | 2.12 | 2.23 | 2.25 |

| 09/17/14 | 1.63 | 2.06 | 2.19 | 2.21 |

| 09/18/14 | 1.56 | 2.02 | 2.21 | 2.19 |

| 09/19/14 | 1.56 | 2.03 | 2.19 | 2.18 |

| 09/22/14 | 1.6 | 1.99 | 2.11 | 2.15 |

| 09/23/14 | 1.63 | 2.02 | 2.14 | 2.17 |

| 09/24/14 | 1.66 | 2.03 | 2.15 | 2.18 |

| 09/25/14 | 1.62 | 2.02 | 2.13 | 2.16 |

| 09/26/14 | 1.59 | 1.97 | 2.09 | 2.13 |

| 09/29/14 | 1.61 | 1.95 | 2.06 | 2.1 |

| 09/30/14 | 1.56 | 1.97 | 2.09 | 2.11 |

| 10/01/14 | 1.6 | 1.96 | 2.07 | 2.11 |

| 10/02/14 | 1.57 | 1.95 | 2.07 | 2.11 |

| 10/03/14 | 1.56 | 1.93 | 2.05 | 2.09 |

| 10/06/14 | 1.55 | 1.93 | 2.04 | 2.08 |

| 10/07/14 | 1.52 | 1.92 | 2.02 | 2.06 |

| 10/08/14 | 1.54 | 1.96 | 2.07 | 2.1 |

| 10/09/14 | 1.52 | 1.97 | 2.07 | 2.11 |

| 10/10/14 | 1.52 | 1.96 | 2.06 | 2.1 |

| 10/14/14 | 1.41 | 1.92 | 2.07 | 2.07 |

| 10/15/14 | 1.37 | 1.86 | 1.99 | 2.04 |