One important thing to have an idea of - for personal and business reasons - is the amount of inflation expected in the future. Think about it - by having a reasonable number to plan for the erosion of the value of your money, you will better be able to make decisions on what loans to take out, what purchases to make, and how to invest.

Luckily for you, there are a few ways to gauge these predictions, which don't resort to guessing, praying, or going to a fortune teller. The methods are also more sophisticated than taking the last few years worth of data, drawing a trend line, and attempting to extrapolate future results.

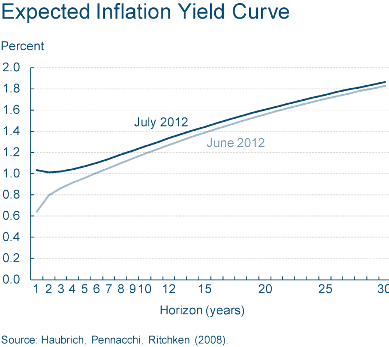

Cleveland Fed Method

The Federal Reserve Bank of Cleveland publishes the results of their model on inflation , which uses inflation swap trades to try to adjust for the shortcomings of our second method. They currently predict (July, 2012) 1.26% inflation over the next 10 years, 1.60% inflation over the next 20 and 1.86% inflation over the next 30. Not bad, historically. Of note, the Federal Reserve has stated they want to keep inflation around 2% long term. Ask Cameron more about that number and why it's likely the target (I can't do it justice).

Treasury Yield Curve Method

There is a much quicker way to eyeball expected inflation, and one we've covered quite a bit (historically) here on the site. Since TIPS, "Treasury Inflation Protected Securities" pay coupon plus the reading of CPI for the period while the regular yield curve tracks what unadjusted debt is currently trading for, simply taking the difference between the two curves leaves us with one measure of inflation expectations. Sure, there is a tax element, issues with trading below 0 element, and other reasons why it is a slightly inaccurate number, but it lets us prognosticators check what the market is roughly thinking on any general day. You can also go back and check the expectations at any date in the past - pretty nifty. Here's the numbers for Thursday, 8/2/2012

So now you've been forewarned - the market is only expecting inflation in the sub 3% range over the next 30 years. Pretty impressive how we can figure that out without picking up a phone and polling people, isn't it? It also make the extremely low price on debt - like mortgages in the 3%s - seem like even better buys.

What do you think about expected inflation rates? Will you be taking advantage of cheap money in the form of debt? Isn't the difference between inflation expectations and mortgage rates incredible?