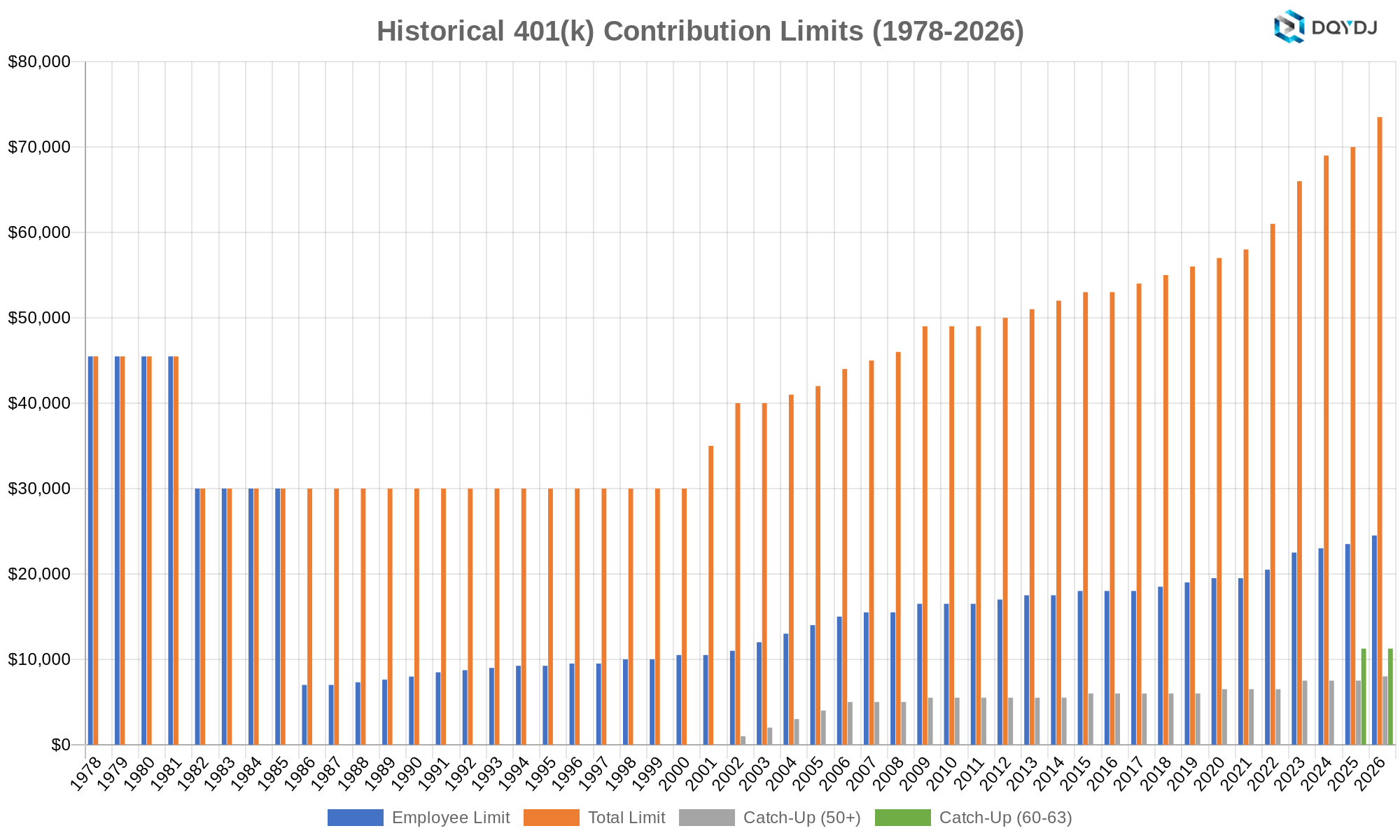

Every year, the IRS sets the maximum 401(k) contribution limits based on inflation (measured by CPI). There are actually multiple limits, including an individual contribution, an employer contribution, and age 50+ catch-up contributions. Starting in 2025, the SECURE 2.0 Act also introduced an enhanced super catch-up for those ages 60-63.

If you're currently working at a company with a plan, we highly suggest familiarizing yourself with its mechanics and any matching funds. Contributing to your 401(k) is an excellent way to help set yourself up for retirement.

What is the 401(k) contribution limit in 2026?

The 2026 401(k) individual contribution limit is $24,500, up from $23,500 in 2025. In 2026, employers and employees together can contribute up to $72,000, up from a limit of $70,000 in 2025.

If you are 50 years old or older, you can also contribute up to $8,000 in "catch-up" contributions on top of your individual and employer contributions. If you are ages 60-63, you can contribute up to $11,250 in catch-up contributions instead, thanks to the SECURE 2.0 Act's enhanced catch-up provision.

Historical Contribution Limits for 401(k) Plans, 1978 - 2026

| Year | Employee Limit | Total Limit | Catch-Up (50+) | Catch-Up (60-63) |

|---|---|---|---|---|

| 2026 | $24,500 | $72,000 | $8,000 | $11,250 |

| 2025 | $23,500 | $70,000 | $7,500 | $11,250 |

| 2024 | $23,000 | $69,000 | $7,500 | — |

| 2023 | $22,500 | $66,000 | $7,500 | — |

| 2022 | $20,500 | $61,000 | $6,500 | — |

| 2021 | $19,500 | $58,000 | $6,500 | — |

| 2020 | $19,500 | $57,000 | $6,500 | — |

| 2019 | $19,000 | $56,000 | $6,000 | — |

| 2018 | $18,500 | $55,000 | $6,000 | — |

| 2017 | $18,000 | $54,000 | $6,000 | — |

| 2016 | $18,000 | $53,000 | $6,000 | — |

| 2015 | $18,000 | $53,000 | $6,000 | — |

| 2014 | $17,500 | $52,000 | $5,500 | — |

| 2013 | $17,500 | $51,000 | $5,500 | — |

| 2012 | $17,000 | $50,000 | $5,500 | — |

| 2011 | $16,500 | $49,000 | $5,500 | — |

| 2010 | $16,500 | $49,000 | $5,500 | — |

| 2009 | $16,500 | $49,000 | $5,500 | — |

| 2008 | $15,500 | $46,000 | $5,000 | — |

| 2007 | $15,500 | $45,000 | $5,000 | — |

| 2006 | $15,000 | $44,000 | $5,000 | — |

| 2005 | $14,000 | $42,000 | $4,000 | — |

| 2004 | $13,000 | $41,000 | $3,000 | — |

| 2003 | $12,000 | $40,000 | $2,000 | — |

| 2002 | $11,000 | $40,000 | $1,000 | — |

| 2001 | $10,500 | $35,000 | — | — |

| 2000 | $10,500 | $30,000 | — | — |

| 1999 | $10,000 | $30,000 | — | — |

| 1998 | $10,000 | $30,000 | — | — |

| 1997 | $9,500 | $30,000 | — | — |

| 1996 | $9,500 | $30,000 | — | — |

| 1995 | $9,240 | $30,000 | — | — |

| 1994 | $9,240 | $30,000 | — | — |

| 1993 | $8,994 | $30,000 | — | — |

| 1992 | $8,728 | $30,000 | — | — |

| 1991 | $8,475 | $30,000 | — | — |

| 1990 | $7,979 | $30,000 | — | — |

| 1989 | $7,627 | $30,000 | — | — |

| 1988 | $7,313 | $30,000 | — | — |

| 1987 | $7,000 | $30,000 | — | — |

| 1986 | $7,000 | $30,000 | — | — |

| 1985 | $30,000 | $30,000 | — | — |

| 1984 | $30,000 | $30,000 | — | — |

| 1983 | $30,000 | $30,000 | — | — |

| 1982 | $30,000 | $30,000 | — | — |

| 1981 | $45,475 | $45,475 | — | — |

| 1980 | $45,475 | $45,475 | — | — |

| 1979 | $45,475 | $45,475 | — | — |

| 1978 | $45,475 | $45,475 | — | — |

The 401(k) was first introduced in the United States in the Revenue Act of 1978, amending the Internal Revenue Code. It started gaining wider adoption in November of 1981 when the IRS proposed regulations clarifying valid sources of income for 401(k) contributions.

Key Dates in the History of the 401(k)

For a detailed history of the 401(k), the Investment Company Institute had an excellent presentation back in 2006 which summarized the history behind the plan. Following are some key laws which shaped the 401(k) and other deferred compensation plans, and left us in the current state.

- 1978

The 401(k) was first created in the Revenue Act of 1978 - November 1981

The IRS clarified the types of income that could be deferred into a 401(k) plan, stating regular earned income qualified and not just profit sharing income. - 1982

The Tax Equity and Fiscal Responsibility Act of 1982 reduced the maximum allowable contribution to the 401(k) from all sources to $30,000 from $45,475. - 1986

The Tax Reform Act of 1986 reduced the amount an individual could contribute to a deferred compensation plan to $7,000, while leaving the overall contribution alone at $30,000. - 2001

The Economic Growth and Tax Relief Reconciliation Act of 2001 increased the contribution limit above $30,000 for the first time since 1981, and added the concept of "catch-up" contributions for taxpayers 50 years old and older. - 2025

The SECURE 2.0 Act of 2022 introduced enhanced catch-up contributions for participants ages 60-63, allowing the greater of $10,000 or 150% of the standard catch-up limit in 2024.

Other Historical Sources on the 401(k) Limit

Along with the excellent ICI presentation, we consulted a number of additional sources for this data:

- Pensions 123

- 2014 Hay Group Reference Guide for Benefits

- Tax Policy Center Maximum Benefits Table

- IRS 401(k) Limit Section (You need to dig for other years)

If you find the 401(k) limit interesting, we also have an article detailing the history of the IRA Limit. To model potential 401(k) growth, see the 401(k) calculator.