There's a few topics we like to return to now and again on this website - our "go-tos" if you will. A few years back we noted that options, although not instruments that we often use, are awesome since the price signals they give us let us estimate three different things:

- Direction - Will a security trade up or down?

- Magnitude - How large a move will a security make?

- Timeframe - How quickly will the security move?

Compare that to stocks - if someone is buying, that means that they are betraying the direction they think the stock will go (up). We don't have a clue about the other two. In essense, the information given to us by options is three times more valuable than that of stocks.

Well, Of Course Options Are Better...

Yes, you're right, Don't Quit Your Day Job wasn't the first to use this metadata to build indicators. People have been watching options price movements for years, and concepts like Options Pain were well known before our site even started.

However, we take it a bit further. We built an options 'implied closing price' calculator way back in December of 2011. You can see the initial results of that effort here, and our thoughts on the quality of the signals (not so amazing).

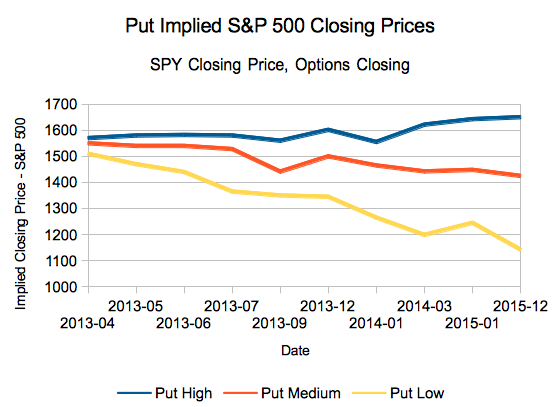

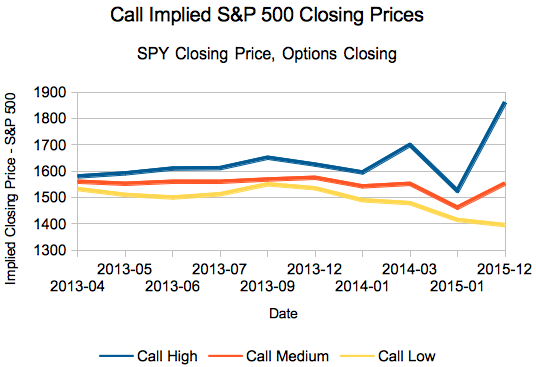

So why continue to push the issue? Truly, there is some mispricing in the options market one of you sharp eyed and quick witted readers can take advantage of... something which might even become evident from me posting these graphs and these charts (The gap between 'High' and 'Low' is 75 percentage points - as in, implied odds are 12.5% more and 12.5% less):

How Do You Predict the S&P 500 Closing Price?

Simple, in a way. The ETF 'SPY' trades for roughly 10% of the value of the S&P 500, so I used the long dated options of that ETF to build these predictions. Roughly, we look at the intrinsic value and the implied time value, and figure out the clusters (automatically) to try to determine where traders think the pricing will fall. Here's the data presented in chart form (Dates are 'options closing' dates):

| 2013-04 | 2013-05 | 2013-06 | 2013-07 | 2013-09 | 2013-12 | 2014-01 | 2014-03 | 2015-01 | 2015-12 | |

| Put High | 1570 | 1580 | 1582.15 | 1580 | 1560 | 1601.73 | 1555 | 1621.66 | 1642.79 | 1650.39 |

| Put Medium | 1550 | 1540 | 1540 | 1527.84 | 1441.53 | 1500 | 1465 | 1442.37 | 1448.24 | 1425 |

| Put Low | 1510 | 1470 | 1440 | 1365 | 1350 | 1345 | 1265 | 1198.71 | 1244.96 | 1142.09 |

| 2013-04 | 2013-05 | 2013-06 | 2013-07 | 2013-09 | 2013-12 | 2014-01 | 2014-03 | 2015-01 | 2015-12 | |

| Call High | 1580 | 1591.65 | 1610 | 1611.55 | 1651.03 | 1625 | 1595 | 1699.46 | 1525 | 1860.34 |

| Call Medium | 1560 | 1552.12 | 1560 | 1559.71 | 1568.39 | 1575 | 1542.26 | 1552.1 | 1461.59 | 1552.85 |

| Call Low | 1532 | 1510 | 1500 | 1512.3 | 1550 | 1535 | 1489.64 | 1478.59 | 1415 | 1395.42 |

As you would expect, uncertainty increases as you move further out in time. These results were retrieved after the market closed on March 28th, so try to figure out where the mispricings lie before the market reopens.

How to Use These S&P 500 Predicted Closing Prices?

Well, we haven't yet gotten around to trying to tease out some correlations and actionable trades on this - but if you read our warning article above, you'll note that the predictions implied by options were only correct 44.3% of the time... even though 75% was implied by pricing. That means that over the universe of the predictions we pulled, over 50% of closing prices were in the implied 25% area - and usually higher.

An amazing year? A coincidence? Well, we won't know for a while - but I present these numbers as is. Hopefully one of you makes a ton of money off of this information!