Since you've now read my treatises on Investor Psychology and the Flaws of the Efficient Market Hypothesis, we're finally ready to discuss what we originally set out to discuss - how to improve on buy and hold investing. We'll talk about how buy and hold is the best option for most investors, but there are promising buy and hold alternatives if you have the right psychology and to go above and beyond.

How Can Buy And Hold Investing Be Improved?

As you know, buy and hold investing has its roots in the Efficient Market Hypothesis, an idea that currently quoted prices of securities perfectly reflect the actual valuation of stocks, bonds, and other assets. To sum it up in a single phrase, they suggest that "if you can't beat them, join them". With buy and hold investing, you accept the market's returns, minus some small cost for management fees and transactions.

In most cases, unless you are willing to put the time in to learn about valuation of individual stocks and all of the other knowledge that comes along with it, buy and hold is a great idea for the vast majority of investors. In fact, only high information investors with a mechanical buy/sell system should even consider leaving the relative safety of the buy and hold arena. As I stated in the last article - the vast majority of individuals (and 2/3 of mutual fund managers!) underperform the market.

However, what if you could take the low time investment of passive investment, and combine it with some sort of valuation metric which gives a decent idea of how to allocate between two asset classes? For example, say you normally split your investments with 60% stocks and 40% bonds and fixed income. If stocks can be shown to be somehow undervalued,could you increase this to 70/30 or 80/20? How about if stocks looked overvalued - could you reduce your holdings in stocks and increase your holdings in bonds?

What if you did this across multiple asset classes - looking at the valuation of that asset versus a historical valuation, and under or over-weighting that asset in your portfolio by extension? Well, at the risk of boring the low-information investors by applying too much thought to this method - there has to be something to this.

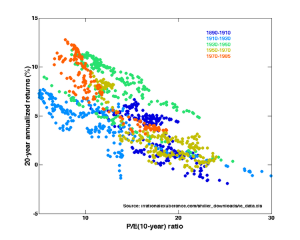

Nearby, you'll find an application of Robert Shiller's (who is more well known for applying valuation to real estate prices in the Case-Shiller index) method of taking the price to earnings ratio of the S&P 500 over the previous ten years and graphing it against subsequent returns. You'll note that as P/E10 increases, average returns for the S&P 500 fall, with better returns coming with lower valuations.

On this site you can even find a Shiller PE and CAPE calculator, which gives the current 10 Year Adjusted P/E, and also allows you to adjust a PE over anywhere from 1 month to 50 years.

Valuation Informed Indexing

Enter Rob Bennett and John Walter Russell's Valuation Informed Investing, or VII. Russell, before his death, released a chart which showed the coefficient of determination (square of the correlation) of 10 year returns and PE/10 having a (somewhat high) .47. For reference, a value of 1, or 100%, would mean two values perfectly track each other, while a value of 0 would mean no relation. To give one example, the Vanguard ETF attempts to track the MSCI US Prime Market 750 Index. It's R-squared is 99.92%, implying that the two move in almost absolute lockstep.

So even though P/E10 isn't as predictive as say an ETF tracking an index, it seems to have decent predictive powers. We have to ask one more thing: are the variables related? The fallacy we are worried about is post hoc ergo propter hoc - basically, saying that a correlation doesn't automatically prove a relationship. (Read more on fallacies in investing here). However, my personal belief is that value methods have proven themselves to be a rather reliable indicator of future returns - even if they don't eventually move markets with absolute predictability.

So, in essence, VII uses this P/E10 (and usually on the S&P 500, where the most research has been done) to decide when to invest in the S&P 500, and when to move to safer assets.

Wade Pfau, writing for the National Graduate Institute for Policy Studies, evaluated a mix of 100% stocks or bonds using a methodology originally advanced by Fisher and Statman in 2006. He showed that yes, using a P/E10 of 16.4 (historic median) to set 100/0 stocks/bonds or 0/100 stocks bonds outperforms buy and hold investing over the long run. Other research by Pfau and Robert Shiller seems to point to a few valuation methodologies which can, surprise, surprise... beat buy and hold (100% stock holdings) even when using the traditional CAPM models for risk. Of course, note that if you are anywhere close to retirement (even using buy and hold) you should move to a less extreme allocation of stock (like 60/40 or 50/50 split with fixed income investments).

Safe Withdrawal Rates

Rather than rewriting a great piece of financial writing, I'd direct you to fellow financial writer Todd Tresidder's writing over at The Financial Mentor. Todd has already written up a post on the history of safe withdrawal rates, and you would be poorly served by me duplicating the tremendous effort he undertook.

The key points of his article are that the "Magic 4%" withdrawal rate that most financial advisers quote is bunk, and is likely only valid for American portfolios due to a confluence of good luck over the last couple of centuries in America. I'd tend to agree here - he cites Wade Pfau heavily in the article, and Pfau even posted this example of safe withdrawal rates for another first world economy over the last century - Japan.

Remember, all of the ideas we just explored don't just inform our asset allocation - they also can be used to predict what a safe withdrawal rate is when you are drawing down your retirement funds and savings. Your biggest risk in retirement is outliving the resources you have acquired, so you want to know how much you can take out early in retirement so you don't have to cut back drastically near the 'end'.

A good place to look to get an idea of your 'length' of retirement is on the Social Security Actuarial Life Table, which will give you the odds they expect you to live a certain length of time based on your age. Your mileage may vary...

If all of this research is to be believed, you should consider valuations when you go to take out funds in retirement. If stocks are insanely overvalued, you might be better served by both switching from stocks and taking out less than the so-called magic 4%, while if they are undervalued you might find yourself able to take out a lot more.

Other strategies which might make sense?

- Set a minimum withdrawal percentage, say 1.5 or 2.0%. Only increase it if your total funds lost with withdrawal are less than some benchmark, say 6%. Your funds may drop 10% one year, so you only take out 1.5%. Another year, they increase 10%, so you take out 4%. They drop 2.5%? You take out 3.5%. Rinse and repeat.

- Take out a percentage of current funds. The 4% number is only a risk if you base it on your original funds and the market drops.

- Recognize the 4% number, and go with something less - like 3. Note that 4% implies you need to save 25 times your annual draw. 3%? 33.3 time. So this method means small movements towards conservatism mean massive increases in resources are needed.

The State of Buy and Hold Investing

Shots are being fired across the bow of the buy and hold ship, but many people... the low information investors for certain... should probably continue to sit tight and monitor the developments. In extreme conditions - like really frothy valuations and insanely cheap stocks, maybe you should consider shifting away form or towards more stocks in your portfolio.

For the high information investors? You should probably read as much on these topics as you are comfortable with. Those of you with ETFs and mutual funds, you should start to fold these concepts into your methodology and start to watch the overall valuation of stocks in your portfolio. Those of you who deal strictly with individual stocks should already have implemented some style of valuation to your buy and sell decisions.

I'm curious to dig into some methods of evaluating the entire market - P/E10, regular price/earnings, dividend yield, earnings expectations, even implied closing prices (my specialty!) or some combination thereof (or something not mentioned here). Perhaps if all of this is interesting or controversial enough, I'll do some of my own informal studies as well, and try to figure out if some are better than others. I'm hoping it is.

What do you think of all of this information? Are you reconsidering your style of investing? Are you going to use valuation to determine the allocation of your mutual funds? How do you think age should factor into your allocation?