As you may be aware, potential (expected) Presidential candidate Rand Paul had something to say about the Federal Reserve the other day:

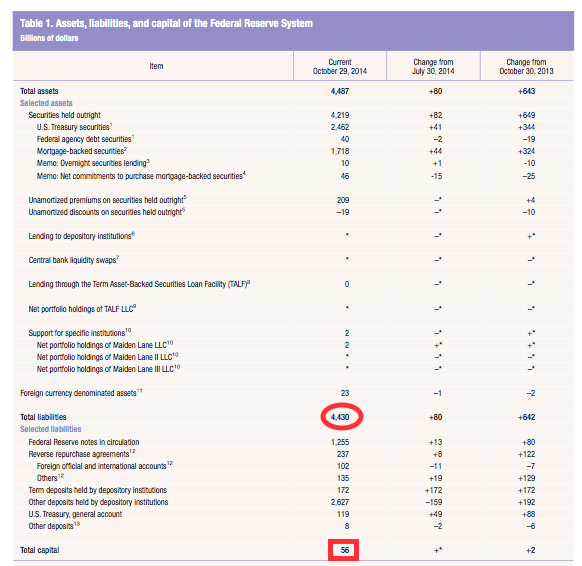

“They’d be bankrupt, they’d be insolvent,” he said. “[The Fed’s] liabilities are $4.5 trillion; their assets are $57 billion. Do the math.

"They are leveraged 80-1. They are leveraged three times greater than Lehman Brothers was when Lehman Brothers went bankrupt. Why do we give ‘em a pass? Because they’ve got a printing press, and they can print up some more money.”

First: yes, he said "assets" when he meant "capital". If that means the rest of his speech means nothing, I guess there is nothing to defend here (see also an argument about the definition of the word "investment" between a Finance type and an Economics type).

However, reading three takes on the incident from people I respect greatly (and follow and read already, hence singling them out...) Noah Smith, Cullen Roche, and Matt O'Brien. I thought their criticisms were too harsh beyond calling out the obviously wrong word choice of "assets". Take a look yourself, or guess from these titles (respectively):

- "Rand Paul's Know-Nothing Fed Bashing"

- "Clueless in Kentucky: Rand Paul’s ideas about the Fed make absolutely no sense"

- "The Federal Reserve Could be Worth Hundreds of Billions of Dollars"

(Okay, the last one's not harsh. I'll go with the closing line: "While perhaps well intentioned, it’s clear that Paul is on an ideological witch hunt driven by his own misunderstandings and populist thinking.")

What is Leverage in Finance?

Let's try to think here for a second - what is leverage?

It's a physics term which happens to apply almost perfectly to finance - the same way Archimedes was able to say about the lever "Give me a place to stand and with a lever I will move the whole world", with enough financial leverage you could buy everything on the earth. Sure, I don't know where you'd borrow the money (and I don't know where Archimedes would set the fulcrum of his lever, let alone what it would be made of), but it's true.

In finance, the reasonable definition of leverage is debt:capital. Forget folks with different definitions: using capital to debt means this leverage ratio explains, perfectly, what happens to that capital during a revaluation. A quick example:

Let's say you buy a house for $1,000,000. You put down $200,000. Ignoring fees and incidentals, on the day you buy the house it is worth $1,000,000 and you have $200,000 in equity (not "assets", as Paul misspoke - in this case, the "asset" is the house, and it is worth $1,000,000).

Using our definition, we are levered 5:1... every move in the asset's value moves your equity five times as much.

Think about it -

If the house's value goes up 20%, $200,000: your equity goes up 100%(!)... to $400,000.

If the house's value goes down 20%, $200,000: your equity goes down 100%(!)... to $0.

So, Paul's math was 'right', at least according to the numbers he quoted. For reference, here is the Federal Reserve's last quarterly balance sheet.

But The Fed Is Already Audited!

Yes, it is, and before I get to the 'but...', let me say I don't have a strong opinion either way on the auditing. When you play with international politics, you have to take certain steps you can't take with a private company - I get it.

(Okay now...) But... it's audited in the same way as Mufasa described Simba's future dominion over the Pridelands in The Lion King: "everything the light touches".

Well, Simba was curious about the dark spot - and hey, turns out that's where the elephant graveyard was located and where the hyenas hung out! There was certainly something going on in that dark spot (not that we have to fear stampedes and regicide, but you get it, you're smart).

So it goes with what auditors can audit at the Federal Reserve. From 31 U.S. Code § 714 (emphasis added):

(b) Under regulations of the Comptroller General, the Comptroller General shall audit an agency, but may carry out an onsite examination of an open insured bank or bank holding company only if the appropriate agency has consented in writing. Audits of the Board and Federal reserve banks may not include—

(1) transactions for or with a foreign central bank, government of a foreign country, or nonprivate international financing organization;(2) deliberations, decisions, or actions on monetary policy matters, including discount window operations, reserves of member banks, securities credit, interest on deposits, and open market operations;(3) transactions made under the direction of the Federal Open Market Committee; or(4) a part of a discussion or communication among or between members of the Board and officers and employees of the Federal Reserve System related to clauses (1)–(3) of this subsection.

But The Fed Is Making Payments to the Treasury!

Oh, you mean Rand Paul isn't treating dividends the same as retained earnings? (Folks who claim to care about the "asset"/"capital" mess-up should understand that. But they could cut the dividend anytime, right?)

If you don't like that one and this it's below the belt, let's say I'm the Federal Reserve and my wife is the Treasury. If I pay my wife money from my income and she spends more than we take in overall... well, if you don't like this analogy, I don't know how I can convince you this matters. Maybe read an Accounting book? A Finance site? (I know a few!)

But the Fed Doesn't Actually Have Liabilities Like We Do - the Fed Prints Money!

Okay fine, I 100% agree with all of you who wrote that (and think that) - you're absolutely right, and when we talk about the zero rate bound and the limits of monetary policy we literally talk about dropping printed money from helicopters. Maybe we'll have "Helicopter Liabilities" on the balance sheet one day.

You know who else agrees? Some guy who was once quoted: "Why do we give ‘em a pass? Because they’ve got a printing press, and they can print up some more money."

That guy? Rand Paul.

Fine, Federal Reserve assets, liabilities, transactions, and policies don't matter too much in the first degree (profits/losses/any other way you look at a regular company) - but in the second degree (inflation and deflation, affecting the rate paid on deposits, crowding out private investing, affecting stock market psychology, etc...) they undoubtedly matter.

Now, look, we're as pragmatic as anyone who knows how to pull up a chart on FRED - witness our posts on how inflation (and inflation expectations) is still low and there is no sign of rampant inflation anywhere, regardless of "money printing". Of course, that doesn't mean that these things are never going to be a concern again - "this time is different" thinking didn't work in 2007, and it won't work the next time, either.

So, there you have it. Other than Rand Paul messing up "assets" and "capital" in his definition of leverage, it turns out everyone agrees in the end, anyway! Consensus reached, deadlock over!

Seriously now, my thoughts on the Federal Reserve are mixed on this issue - I make exceptions for international politics, and I don't think there is some massive conspiracy hidden on the books (but I'm sure there are some inconvenient entries. Certainly no hyenas, of course.). I'd probably lean at this point to keeping some exceptions to a full audit - or finding a way to plug any leaks which might damage the international order.

I just thought these takes were a bit unfair - an Ophthalmologist got it basically right. I'll try not to be too harsh when I see people confusing technical terms in the future!

What do you think?