When you follow an investment writer for a while, sometimes it's impossible to pin down his or her exact thoughts on the market.

Let's face it - we writers are human, and as humans, we may present biased information without even knowing it. That can come in a number of different forms - we might come off more bearish or bullish than we actually are, we might subconsciously be bragging about our smarter wins and hyping our well-timed moves... and, of course, we might avoid sharing our losses and our mis-timings. Even without meaning to do it, this can throw off our readers from what we're actually thinking about the current state of affairs.

That's why, once a year, I like to delve into my own personal holdings to clarify things for myself and to present an unbiased picture of my portfolio to you readers. Take this opportunity to draw your own conclusions about my prowess with the 'Buy' and 'Sell' buttons.

Call this the Great Article of PK Unbiasing... or 'Small', if you think I mostly tell the truth.

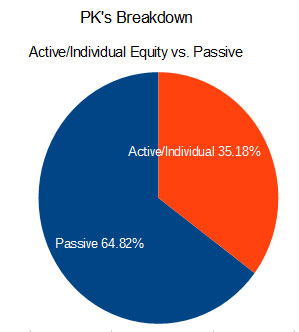

Active vs. Passive Investing

So, make your predictions - a site which spoke 3/4 of a year ago on the market's valuation from a macro perspective, we answered "can you beat the market?" in the affirmative, we pick esoteric well-researched securities in annual contests, we track our active performance versus the S&P 500 Total Return Index, and we ramble on and on about CAPE.

How much of our portfolio, would you guess, is active, and how much is tossed into the hands of an outside party?

('Active' currently includes cash I control plus individual stocks. There are no fancy ETF plays, as I don't own anything, even ETFs of the types in my contest pieces - in future articles if I make a play I will count those types of ETFs here.)

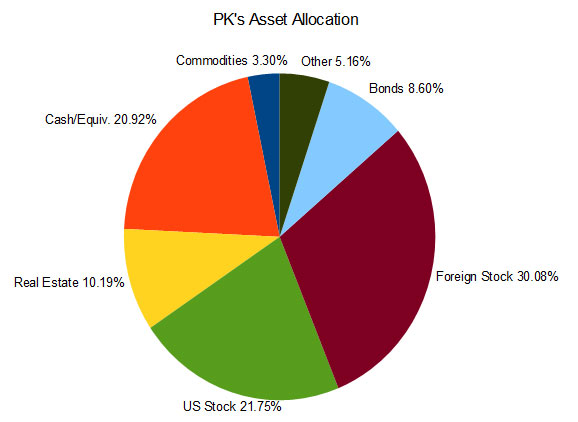

Asset Classes

Specifically, this represents the asset classes across all of the accounts of my wife and I - but doesn't count real estate held in my name or her name. 'Other' is anything that doesn't fit in the rest of the categories. 'Cash' includes both cash that my wife and I control and cash held on our behalf inside of other investments. (And for the Piketty fans: it doesn't go a step further and count cash held on our behalf in individual companies).

So, I'm either 79% invested, or 70% invested, depending on how you count the bonds - and yes, that's much lower than I was a year ago (I was about 98-100% invested, if you count the bonds). Chalk that up to the lack of tempting investments I see in the active part of my portfolio - although, like I said, the majority of the portfolio obviously remains passive.

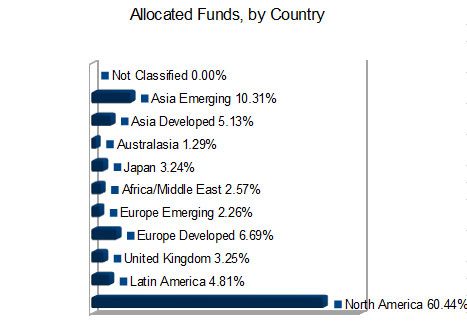

Country Allocation

I sort of delved into country by country investing above, but if you back out the cash & equivalents and leave the other 80%, here is my country by country breakdown:

Methodology and Closing

The breakdown was mostly done using Morningstar's excellent Instant X-Ray tool ('Australasia' is their term, haha), plus me filling in the gaps for things without entries on Morningstar.

So, I hope that helps you understand a bit more about what I'm doing with our portfolio currently. I don't know how much is different from the face I present on DQYDJ, other than maybe my passive/active split (which, again, I denote by me picking individual equities versus buying something/someone's advice which does it).

How does your portfolio look at the moment?